Have you ever wondered how to make your money work for

you, instead of just sitting in a bank account?

One of the most popular ways people grow their money

over time is by investing. And a mutual fund is one of the easiest ways to

start.

If you're completely

new to this, don’t worry. This article will walk you through what a mutual fund

is, how it works, and why it might be a good choice for someone like you who

wants to start investing — without needing a degree in finance.

1.

What

Is a Mutual Fund?

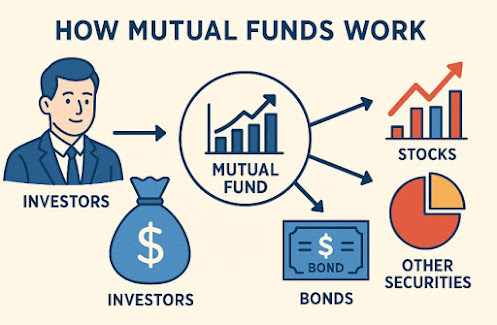

Let’s imagine a big

pot where lots of people put their money together. This pot of money is then

used to buy many different things, like shares of companies (stocks),

government or company debt (bonds), or other investments. This big pot is

called a mutual fund.

When you invest in

a mutual fund, you’re joining lots of other people in pooling your money. A

professional called a fund manager

decides how to use the money to try to grow it over time. Think of them as the

chef who uses everyone’s ingredients to make the best possible dish.

There are a few reasons why mutual funds are so

popular, especially for people who are just starting:

- Diversification: This means not putting all your eggs in one

basket. Mutual funds invest in many different things, so if one company

doesn’t do well, others might do better and balance things out.

- Professional Management: You don’t have to pick which stocks or bonds to

buy — a trained expert does it for you.

- Low Barrier to Entry: You don’t need a lot of money to start. Some

mutual funds let you invest with as little as £100 or less.

- Convenience: Mutual funds are easy to buy and sell, and they save you time.

2.

How

Mutual Funds Work in Practice

Let’s say Peter

wants to invest, but he doesn’t know much about stocks or the economy. He’s

worried he might pick the wrong company. So instead of trying to choose one

stock, he decides to invest £1,000 in a mutual fund.

That mutual fund

takes Peter’s money and combines it with money from thousands of other

investors. The fund manager uses this large pool of money to buy a mix of

stocks and bonds — perhaps shares in companies like Apple, Unilever, or BP, as

well as some government bonds.

Every day, the

value of the fund changes depending on how those investments perform. If the

companies grow and make money, the value of the fund usually goes up. If they

don’t, the value might go down. Peter can check his fund’s value online and

decide to keep investing, add more money, or sell his part if he needs cash.

There

are several types of mutual funds. Each has a different goal and strategy:

A. Stock Funds

(Equity Funds) – These focus on

shares of companies. They can grow a lot over time but may also go up and down

more.

B.

Bond Funds (Fixed Income Funds) – These invest in loans to companies or governments.

They usually offer lower growth but are more stable.

C.

Balanced Funds – These mix stocks and bonds. They aim for both growth and safety.

D. Index Funds – These try to match the performance of a specific

market, like the FTSE 100 in the UK. They are often cheaper because they’re not

actively managed.

E.

Money Market Funds – These are very low-risk and hold cash-like

investments. They don’t grow much but are safe and easy to access.

3.

Costs

to Know About

While mutual funds

are convenient, they’re not free. Here are the main types of fees you might

encounter:

- Management Fee (also called an expense ratio): This is a small yearly charge taken by the fund

manager to handle your money — often around 0.5% to 2%.

- Entry or Exit Fees: Some funds charge a small amount when you buy

or sell.

- Performance Fees: Rare, but some funds charge extra if they

perform really well.

Always check these fees before investing. Over time, they can affect how much money you earn.

4.

Risks

Involved

No investment is

completely risk-free. Mutual funds can go up or down depending on the economy

and the markets. However, because they spread your money across many

investments, they are usually less risky than buying a single company’s stock.

It’s also

important to stay invested for a long time. Mutual funds work best when you leave

your money in for years, giving it time to grow.

5.

How

Do You Start?

Getting started

with mutual funds is easier than you might think:

1.

Set your goal – Are you saving for retirement, a house, or your child’s education?

2.

Choose a platform – Many banks or online investment apps let you buy

mutual funds.

3.

Pick your fund – Decide what type fits your risk level. If unsure, balanced or index

funds are often a good place to start.

4. Invest regularly – Many people put in a small amount each month, which helps smooth out ups and downs.

Final Thoughts

Mutual funds are a

simple and smart way to begin investing. They let you join forces with other

investors, get professional help, and benefit from spreading your risk. While

there are no guarantees, if you start small, stay patient, and invest

regularly, you can build wealth over time — just like Peter.

📘 Quick Questions &

Answers

No comments:

Post a Comment